3/22 Update: One thing that my list below didn’t convey is how much of the plan will be rolled out over time; for example, the Cadillac plan tax isn’t implemented until 2018. This excellent Reuters article outlines the whole plan in chronological order:

In the interests of not exploding from near-constant frustration, I’ve deliberately avoided blogging about (or, as much I can, thinking about) the health-care debate as Congress has been even more ridiculous than usual bringing it to fruition.

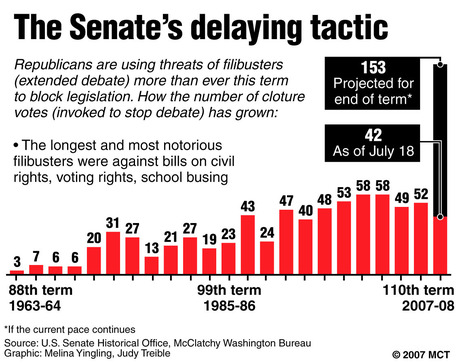

To review: on November 7, 2009, the House passed the Affordable Health Care for America Act by a vote of 220-215. On Christmas Eve, the Senate passed the Patient Protection and Affordable Care Act (what’s with these names, honestly) by a vote of 60-39. In the 2½ months since, Congress has done a spectacular job getting a whole lot of nothing done, and the filibuster, that most delightful of obstructionist legislative tools, has turned into the Republicans’ new best friend:

But. Despite the GOP’s most valiant of efforts… despite President Obama being surprisingly aloof through most of the adventure… despite the American public becoming justifiably fed-up with the whole affair… it’s finally come together. And even in its worst, most compromise-weakened form, it’s still the most dramatic reform of American health care since Medicare and Medicaid in 1965.

First of all, just the facts. Rumors and implications and unintended consequences aside, exclusions and rejected ideas aside, what does this bill actually do? Well, a whole hell of a lot, actually. Unlike the vast majority of Congressional legislation, it’s a grab-bag of new laws, restrictions, taxes, allowances, and three or four kitchen sinks.

Individual and Business Mandates

American citizens will be required (yes, required) to obtain health insurance that meets certain minimum requirements. The justifications for, and criticisms against, this idea I’ll cover separately, but for now, think of it as a way to initiate something resembling universal health care without actually ditching the capitalist privatized system in place right now. (But what about the poor people, you ask? See the next bullet point.)

Simultaneously, and as a partial means to satisfy the individual mandate, businesses with 50+ employees would be required to either offer health insurance or pay taxes to defray the government subsidies that they’d use (again, see next bullet point). Bonus fact: the tax (about $2k per worker per year) would exempt the first 30 employees. So if you’ve got 50 employees at your business, but don’t offer insurance yourself, the penalty would be $40k per year. I’m honestly not sure how this compares with the cost of just offering the insurance.

Insurance Exchanges

For businesses and individuals alike, each state would have its own “exchange” of insurance plans through which people could shop for plans. (These exchanges are generally considered a weak-tea replacement for the public option that progressives were so keen on offering.)

Plans joining the exchange would have to meet certain minimum requirements for coverage, so that (like me, in 2003) you won’t find out after the fact that your insurance only covers $1,000 worth of outpatient expenses. (I just finished paying the hospital bill for that visit off last year.) See here for the coverage they’ll have to offer.

And for people making up to 400% of the poverty level—about $45k for individuals, $88k for a family of four—plans on the exchange offer some level of government subsidy to make them affordable. (There’s still Medicaid for the truly poor people; see below).

Changes to Medicaid

Medicaid is socialized health-care for the needy, which includes low-income people, but also pregnant women, children without other coverage, the disabled, and so forth. Under the bill, it would be expanded so that, under certain circumstances, income alone would qualify a family for coverage (the ceiling: 133% of the statewide poverty level).

Now, Medicaid is jointly funded by state and federal governments, and it’s become a “major budgetary issue in many states.” So to make the states happier, the fed will cover a greater percentage of the bill for the people who are newly-eligible (all of it in 2010,

This still doesn’t make fiscal conservatives happy, and isn’t the ideal solution regardless; for one thing, Medicaid benefits aren’t the best in the world and are being cut back upon. And if Fox News is to be believed, new Medicaid clients will represent fully half of the 32 million Americans to gain insurance. So I’d say there’s a valid conversation to be had about this end of the ruckus.

Changes to Medicare

- The Medicare donut hole—quite possibly the bane of your Granny’s existence—gets closed, though very gradually (not totally gone until 2020). In the meantime, Granny gets up to a $250 rebate to defray donut-related costs, and (starting in 2011) a 50% discount on name-brand drugs.

- Medicare gets a new semi-indepedent group, the Independent Payment Advisory Board, which is made up of health-care professionals and sets Medicare policy (as opposed to, say, Congressmen). Read more here.

New rules for insurance companies

Quoted from here:

- Six months after enactment, insurance companies could no longer denying children coverage based on a preexisting condition.

- Starting in 2014, insurance companies cannot deny coverage to anyone with preexisting conditions.

- Insurance companies must allow children to stay on their parent’s insurance plans through age 26.

Paying for all this craziness

We’ve heard the trillion-dollar number thrown around for over a year now. Here’s (partly) where it’s coming from:

- Expanded taxes on the rich, primarily via a new investment tax for wealthy Americans.

- A new tax on “Cadillac” health-care plans. They’re described nicely here, or if you’re too lazy to click: “The top-of-the-line plans—say, the $40,000-a-year plan offered to Goldman Sachs CEOs—likely have no copayments, no deductibles, few limits on how much you can spend, and no need for prior authorization.”

- My personal favorite: a 10% tax on indoor tanning salons. There’s one set of small businesses that I’m NOT worried about taking a hit.

- $500 BILLION IN MEDICARE CUTS. I wrote that like Republicans have been saying it, and heck if it doesn’t sound scary when you put it that way. FactCheck.org has an excellent summary here, but this is the most relevant, contextualizing point: “it’s a $500 billion reduction in the growth of future spending over 10 years, not a slashing of the current Medicare budget or benefits.”

Whew.

Did I get it all? I think I got the biggest points down. I’m gonna have a second burst of HCR-related blog posts to cover some of the biggest controversy drivers. But lemme offer one big opinion thus far:

IT’S NOT A FRICKIN GOVERNMENT TAKEOVER OF HEALTH CARE.

this helps, really concise, thanks!